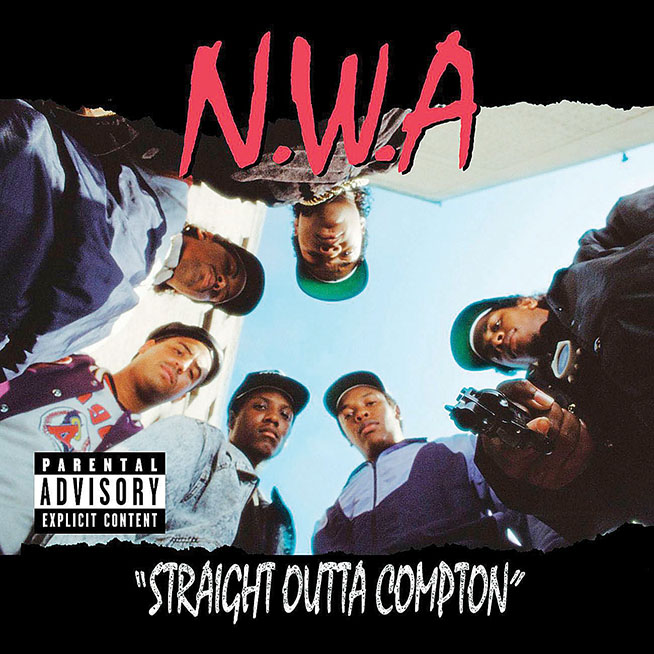

DJ Yella – sampling, drum programming on seven songs, rapping on one song.Dre – keyboards, drum programming on five songs, rapping on five songs Arabian Prince – rapping on one song, keyboards, drum programming on five songs.Dre and DJ YellaĢ007 reissue (20th Anniversary Edition) bonus tracks In 2017, it was selected for preservation in the National Recording Registry by the Library of Congress as being "culturally, historically, or artistically significant". Straight Outta Compton redefined the direction of hip hop, which resulted in lyrics concerning the gangster lifestyle becoming the driving force in sales figures. In 2003, it was ranked number 144 in Rolling Stone magazine's list of the 500 greatest albums of all time, maintaining the rating in a 2012 revised list, the fifth highest ranking for a hip-hop album on the list. It has been considered to be one of the greatest and most influential hip hop records by music writers and has had an enormous impact on the evolution of mainstream hip hop. This was the group's only release with rapper Ice Cube prior to his 1989 departure. The album has been viewed as the pioneering record of gangsta rap with its pervasive graphic profanity and violent lyrics. When interest rates are rising,ĭepositors should avoid committing their money for long periods of time.Straight Outta Compton is the debut studio album by American hip hop group N.W.A. When interest rates are falling, it is often preferable to lock in high rates for an extended period of time with a longer-term CD. Offer better rates on six month CDs but the accounts must be opened online. But investors looking for a place to stash some cash might still find CDs an attractive place for some of their savings. Since the financial crisis in 2008, CDs have become less popular because the yields they offer have dropped precipitously, making it difficult for retirees and savers Online banks tend to useĮlectronic funds transfer or check via mail. One advantage of a branch-based bank is that a depositor can walk into the bank and receive their interest that day in the form of a check. Some banks pay interest monthly, other semi-annually, and others at the maturity of the CD. The method of distributing the interest earned on a CD varies by bank. This is especially true for longer-term CDs opened in low interest rate environments. Inflation can often run higher than the inflation adjusted return on a CD, thus eroding the value of the money stored in the CD over time. To put money that will generate a predictable return. If FDIC insured, the CD represents a safe place CD RiskĪlmost all banks provide CDs to their consumers and they have been a mainstay of savers and retirement accounts for years.

In stable rate environments, CDs that are over 12 months in length can enable depositors to pick up a slight premium over savings accounts. If rates are going down, then the opposite is true, and savers should try and lock into a good rate for an extended period of time. In general, if rates are going up, savers should avoid putting the Individual depends on their goals, the rate they which to earn, and their future plans for the money. Terms can either be described in months or years. Terms can run for any period of time but in general, banks use the following terms:ģ months, 6 months, 12 months, 18 months, 24 months, 36 months, 48 months, and 60 months. The time period in which money is held in a certificate of deposit is called the term. Interest penalties and is generally not advised. While it is possible to withdraw the money earlier (breaking the CD) doing so comes with high Of money for a set period of time, in return for a fixed rate of interest. Certificates of Deposit - Branch Banks 2023Ī certificate of deposit (CD) is a savings product offered by a bank in which a depositor (someone who has money to put into the bank) agrees to commit a certain amount

0 kommentar(er)

0 kommentar(er)